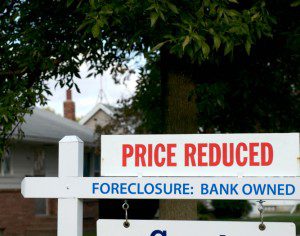

The idea behind the Independent Foreclosure Review seems simple. During the peak of the foreclosure crisis, the banks broke laws and made errors that hurt homeowners. In response, the government mandated they compensate the victims.

But there is growing evidence some banks are playing a major role in identifying the victims of their own abuses, raising the question of whether the review is compromised by conflicts of interest.

Last week we reported that Bank of America, according to bank employees and internal memos and emails, is performing much of the work itself. Now, a ProPublica examination of contracts that outline what work the banks would do on the review shows that America’s four largest banks all planned to participate heavily in evaluating whether homeowners were harmed. Three of the four banks would even help set how much compensation victimized homeowners would receive.

The four banks — Wells Fargo, Citibank, JPMorgan Chase, and Bank of America — together account for about three quarters of the 4.4 million homeowners eligible for the program.

Read More Here: http://bit.ly/T3ec42

These banks caused the problem and are now self governing the fix. What is wrong with this picture.