The Senate’s attempt to fix the state’s no-fault automobile insurance market passed its first hurdle Thursday with backers conceding the final product may be much different as the bill proceeds to the floor.

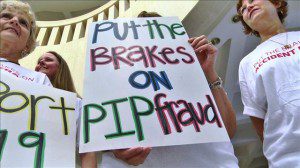

With traditional combatants voicing concerns but choosing to fight it out later, the Senate Banking and Insurance Committee by unanimous vote approved a measure, SB 1860, that the bill’s sponsor said could reduce costs of personal injury protection insurance up to $125 million a year by reducing fraud, more closely regulating providers and limiting the kinds of treatment available to victims following a crash.

Sponsored by Sen. Joe Negron, R-Stuart, the Senate proposal takes a more surgical approach than its House counter proposal as both chambers attempt to clean up an industry that is increasingly riddled by fraud, skyrocketing claims and premium increases despite a drop in the number of crashes.

“SB 1860 reforms PIP from start to finish,” Negron told members before the vote.

Thursday’s 9-0 vote comes after hours of testimony and committee hearings over several weeks in which the committee heard from a host of players from the medical community, insurance industry and legal profession. Belying the complexity of the issue, a working group set up by Chief Financial Officer Jeff Atwater last year adjourned without reaching consensus on a comprehensive list of recommendations.

Established in the 1970s, PIP was created to offer victims of car crashes some medical assistance regardless of who caused the accident. The system pays up to $10,000 in medical costs. Changes made in 2007 to make the system less litigious may have had the opposite effect as the number of claims and payouts escalated despite a drop in the number of accidents.

Critics blame scam artists, organized crime and unscrupulous providers and profit-seeking attorneys for creating a lucrative market that is costing legitimate policyholders hundreds of millions in additional premiums every year.

To curb fraud, the Senate bill makes accident victims fill out more detailed crash reports and gives law enforcement officials the ability to attend hearings or submit affidavits to augment the crash report. The bill also requires treatment to be conducted at licensed clinics.

The bill prevents insurance companies from adding plaintiff’s attorney costs to their base rates.

Unlike the House plan (HB 119), the Senate version does not place restrictions on certain attorney fees. The Senate plan, for example, does not cap fees or eliminate the multiplier, which allows attorneys to collect additional fees based on the complexity of the case.

The Senate plan also does not require that injured motorists seek treatment at a hospital emergency room within 72 hours of the crash, a provision also included in the House proposal. Instead, the Senate plan allows patients to continue to see their private physicians.

“We want to give people peace of mind that if they are involved in an accident they will get their legitimate treatment paid for,” Negron said.

Representatives from the business community and insurance companies say they want stricter regulations to curb attorney fees but chose not to speak Thursday against the Senate plan, which faces at least one more committee stop before reaching the Senate floor.

During debate, committee chairman Sen. Garrett Richter, R-Naples, introduced a handful of amendments that would have placed fee restrictions on plaintiff lawyers and allowed insurance companies to put medical providers under oath. Both provisions have the support of business groups and insurance companies.

Though Richter withdrew the amendments, backers of tougher requirements said they will bring the issues up again before the bill reaches the floor.

“This is a priority for Florida because it is costing every driver in the state a lot of money,” Richter said. “How we try to solve it is controversial. Some want to go further. Others don’t want to go as far.”

By Michael Peltier