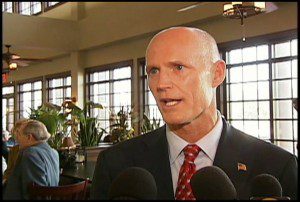

Gov. Rick Scott on Thursday told Realtors in Orlando that he will continue to pursue his quest to abolish the state’s corporate income tax by asking lawmakers this year to raise the exemption to $75,000.

Scott, speaking at the National Association of Realtors convention in Orlando, said he will go back to lawmakers again to reduce the number of Florida businesses that are required to pay the tax. The governor has already been successful twice in convincing lawmakers to raise the threshold before corporate tax kicks in.

“I’ve made a commitment to the people of Florida to eliminate the business tax over seven years – and over the past two years we have been able to eliminate the tax for more than 75 percent of businesses that fall under it,” said in a statement after meeting with Realtors.

In 2010, lawmakers raised the business tax exemption to $25,000, a level that resulted in about 10,000 businesses no longer being required to pay. Last year, another 3,770 businesses no longer had to pay as lawmakers upped the exemption to $50,000. That exemption kicks in Jan. 1 and is expected to result in a recurring reduction of $29.4 million.

Scott estimated Thursday that the additional exemption would result in 2,000 businesses no longer being required to pay corporate tax.

After refunds are taken into account, Florida is expected to collect nearly $2 billion in corporate income taxes this fiscal year, according the Legislative Office of Economic and Business Research. If enacted, the higher exemption would reduce collections by less than $10 million.

Scott’s announcement brought immediate praise from the state’s largest business groups, which applauded the continued effort to improve the economic development climate in the state.

“Gov. Scott’s plan to let more small businesses keep more of their bottom line will go a long way in making Florida the best place in the world to grow businesses and find a job,” said Bill Herrle, NFIB / Florida executive director.

Florida Democratic Party executive director Scott Arceneaux, however, blasted Scott’s announcement, saying in a statement that the governor’s push for tax breaks runs counter to Tuesday’s elections results, which indicate that Floridians are more concerned about adequate funding for such things as roads and education and less about further cuts in businesses taxes.

“These are the wrong priorities to grow our economy, they are the wrong priorities to move our state forward, and they are same failed ideas that are out of touch with Florida’s values and have been rejected by Florida’s citizens,” Arceneaux said.

“I believe that most Florida employers want a well-educated workforce, not necessarily tax cuts that do little to help grow their businesses,” added Rep. Jim Waldman, D-Coconut Creek.

Republicans will hold a majority of at least 30 seats in the House and a 26-14 majority in the Senate in the coming year.

by Michael Peltier

[…] cutting early voting days and opportunities. On top of everything else, Rick Scott continued his big giveaways for big corporations, while funneling money to charter schools instead of public schools and refusing to implement […]