Ending months of debate and uncertainty, Progress Energy Florida said Tuesday it will permanently shut down a damaged Crystal River nuclear plant that has not generated electricity since 2009.

Progress and its parent company, Duke Energy, rejected the possibility of making costly repairs and decided to begin a decades-long process that ultimately will lead to dismantling the plant and decontaminating the site. The situation, which began with a crack in a containment building at the plant, is unprecedented in Florida.

“We believe the decision to retire the nuclear plant is in the best overall interests of our customers, investors, the state of Florida and our company,” Jim Rogers, chairman, president and CEO of Duke Energy, said in a prepared statement. “This has been an arduous process of modeling, engineering, analysis and evaluation over many months. The decision was very difficult, but it is the right choice.”

State Public Counsel J.R. Kelly, whose office represents consumers in utility issues, said he had hoped Progress would repair the plant, so long as it was feasible financially and from an engineering standpoint. He said he feels for Progress employees who will have to find jobs elsewhere and for Citrus County, which will lose a large chunk of its tax base.

“I certainly can understand the decision, but it’s just a sad day for everybody involved,” Kelly said.

But the Southern Alliance for Clean Energy, which is heavily involved in nuclear issues in Florida, hailed the decision to shutter the plant, saying it “closes a financially tragic chapter in the history of nuclear power in Florida.”

“Crystal River clearly demonstrates the vulnerabilities of being overly dependent on a high-risk energy source like nuclear power, which exposes ratepayers to high financial risks and residents to unnecessary health and environmental risks,” alliance Executive Director Stephen Smith said in a prepared statement.

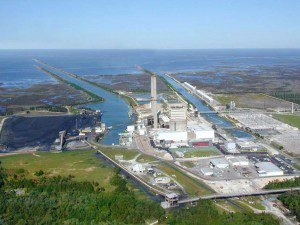

The plant, which began operating in 1977, faced an initial shutdown after a containment building was damaged in 2009 during a project to replace a steam generator. In early 2011, as the plant was getting prepared to operate again, additional cracks were discovered in different parts of the containment building.

The additional cracks — damage known in the nuclear industry as “delamination” — touched off a complicated debate about whether Progress should permanently close the plant or try to repair it. Along with difficult engineering issues, the debate included questions about the repair costs and how much money the utility could recoup from an insurer.

A consultant’s report last year put the minimum repair costs at nearly $1.5 billion, but said a “worst-case scenario” would cost $3.43 billion. As recently as last month, a Progress attorney told the Florida Public Service Commission that the utility had not decided whether to repair the plant.

The decision to shut down the plant has implications that will last for decades and affect employees and customers of the utility. In addition to the loss of the electricity the plant generated, Progress said in a news release that its actual dismantlement could take 40 to 60 years.

Progress plans to use a “safe storage” strategy for dealing with the site, which allows it to spread out costs over a long period of time. The federal Nuclear Regulatory Commission says that approach involves maintaining and monitoring a nuclear facility “in a condition that allows the radioactivity to decay; afterwards, it is dismantled and the property decontaminated.”

To cover the hefty costs of shutting down nuclear plants, utilities are required to gradually build up money in reserve funds. Progress spokeswoman Suzanne Grant said the utility has about $600 million in its “decommissioning” fund and that the amount will grow with investment earnings. She said the fund should have enough money to cover the utility’s costs.

Meanwhile, Progress also is looking at building a natural-gas power plant that could help replace the lost generation from the nuclear facility. The utility said such a new plant could start operating as early as 2018.

The nuclear plant has about 600 full-time employees, along with hundreds of contract workers. While many employees will continue working at the site during the closure process, the utility said it also will try to place workers in other jobs within Duke Energy companies.

Part of the complexity in the debate about the plant has centered on how much money an insurer, Nuclear Electric Insurance, Ltd., would pay to offset Progress’ costs. Those costs include repairs and hundreds of millions of dollars that Progress has spent to buy or generate electricity elsewhere to make up for the lost production at Crystal River.

Tuesday’s announcement came after a mediation process that led to the insurer agreeing to pay $530 million. That came on top of $305 million that it had paid earlier. Progress said the $530 million will flow back to customers to reduce their electric bills.

But Jon Moyle, an attorney for the Florida Industrial Power Users Group, which has been closely involved in the Crystal River issue, said the insurer should have paid more. The group has argued, in part, that the two different discoveries of cracks at the nuclear plant should be considered as separate incidents for insurance purposes — which would have increased the potential insurance payments.

“The $530 million settlement with NEIL (the insurer), we believe is a great deal for NEIL and a bad deal for rate payers,” said Moyle, whose group represents major power customers.

by Jim Saunders