When I started this piece I tried running through my head some relationship to Social Security to which I could relate, but there was nothing. Even as I read through the available data I just couldn’t relate to anything other than the fact I have paid into the program all my life, and it’s my understanding it may not be there when I retire, and I’m not that far from the eligible age. Of course I have been hearing this for years, but as of right now there is more money being taken in than is being paid out, but I am told by numerous sources that will come to an end by sometime around 2015 and the program will be bankrupt by 2045. That is very disconcerting. It’s like being told the warranty on your new car won’t be honored just after your transmission fell out. So much for the security part. Maybe we should call it the Social Distress Program.

Like me, many are worried about the status of the program and of course congress is debating answers on a fix, to include privatizing the program. Both sides of the argument, and I mean argument, are screaming. There doesn’t seem to be a middle bracket for the argument from many of the people I have spoken with, but if the program is to survive, there has to be an answer now.

A Little History Lesson About Social Security

Social Security is nothing new. Even as far back as the seventeenth century England had programs in place for the poor, actually called “Poor Laws”, placed into their society in 1601. This proved to society the public had the responsibility to help those who couldn’t help themselves. Although critical in their definition, the law was still there to help. Taxes were instituted to ensure the help would be there. This foundation of charity was brought to the new world and provided a foundation of the program we have today.

The end of the Civil War brought tens of thousands that needed financial help. Widows, children, and wounded abounded. With that America’s conscience responded. A pension program was developed for those affiliated with the war and in need. In spite of some diverse complaints about the handling of the program the people and the government felt the warriors and the families deserved the assistance. Various programs had been in place since before the Declaration of Independence but the Civil War Pension plan was the first of its kind. It had actually started right at the beginning of the war, in 1862, and became refined over the years. It provided initially for disabled veterans to receive pay for their families based on what they would be paid if they had been killed. By 1890 the veteran could receive benefits whether the disability was service related or not, and then in 1906 even old age qualified, driving the budget up by $165 million in 1893 and was the single largest budget expenditure and was thirty – seven percent of the 1894 budget, and that didn’t even include Confederate Soldiers or the general population. As skewed as those numbers appear, bear in mind the budget didn’t have nearly the needed spending we have today.

A few companies began building pensions into their costs but they were small programs and provided little in the way of retirement, but the seed had been planted. By 1930 a lot of things had transpired to feed the desire for a Social Security program. From the urbanization of America as the result of the industrial revolution, to people living longer, much as we see now, the need for some type of program continued to bloom. No longer did people have their farms to fall back on as people moved to the cities to work in factories. The large families that had existed previously, and had taken care of grandparents and the disabled, began to disappear as the migration to the cities continued. More and more the cities and the government were beginning to feel the weight of need as people aged.

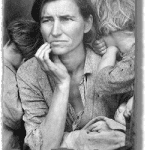

The 1930’s brought a wretched life for many due to the collapse of the stock market. Unemployment increased exponentially and spiked to one – quarter of the population. According to the Social Security Administration website (http://www.ssa.gov/history/briefhistory3.html) the stock market financially affected America more than any single event until then:

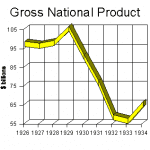

“As America slipped into economic depression following the Crash of 1929, unemployment exceeded 25%; about 10,000 banks failed; the Gross National Product declined from $105 billion in 1929 to only $55 billion in 1932. Compared to pre-Depression levels, net new business investment was a minus $5.8 billion in 1932. Wages paid to workers declined from $50 billion in 1929 to only $30 billion in 1932.”

Across the nation cries rang out loudly that something had to be done to help the huge segment of the population fighting daily just to stay alive. Programs sprang up in America at an incredible rate started by the Populist movement “Share Our Wealth” headed up by Huey Long of Louisiana, and continued by Francis E. Townsend of California. His program, The Townsend Old Age Revolving Pension Plan, commonly called the Townsend Plan, would be based on a two percent sales tax. Townsend published his plan and by 1933 there were over 7,000 Townsend Clubs and over 2.2. million members trying to make the plan law. Participants had to qualify through three items:

1. The person had to be retired.

2. They could not be proven criminals.

3. The money had to be spent within thirty days within the U.S. borders (I like this one especially.

Qualified people would get $200 a month, which at the time was a reasonable amount. In 1935 the Social Security Act came into being and almost all of the programs that brought about change disappeared but the Townsend Act remained in existence until the final amendments to the Social Security Act and almost became its replacement, but Social Security was becoming increasingly entrenched.

Movements came and went throughout the thirties across the nation, some were schemes, and others were good ideas, but Social Security grew in strength becoming the gold measure for social justice and human assistance.

Letters to President Roosevelt requesting aid and compassion became increasingly sad and came by the thousands. Roosevelt looked at other social insurance programs around the world and deemed that without question the contributory program would suit the required need. He had been an advocate for social insurance since 1912 and as a Progressionist addressed the convention saying:

“We must protect the crushable elements at the base of our present industrial structure…it is abnormal for any industry to throw back upon the community the human wreckage due to its wear and tear, and the hazards of sickness, accident, invalidism, involuntary unemployment, and old age should be provided for through insurance.” TR would succeed in having a plank adopted in the Progressive Party platform that stated: “We pledge ourselves to work unceasingly in state and nation for: . . .The protection of home life against the hazards of sickness, irregular employment, and old age through the adoption of a system of social insurance adapted to American use.”

On August 14, 1935 the Social Security was signed into law. The administration was picked and numbers were developed. Thirty million cards were issued at that time. A little bit of trivia is the first card was issued to John David Sweeney, Jr. of New York and the lowest number was issued to New Hampshire resident, Grace Dorothy Owen. Ms. Owen received number 001-01-0001.

From its humble beginnings the program has evolved into a huge set of social programs to include but not limited to:

1. Federal Old-Age, Survivors, and Disability Insurance

2. Unemployment benefits

3. Temporary Assistance for Needy Families

4. Health Insurance for Aged and Disabled (Medicare)

5. Grants to States for Medical Assistance Programs (Medicaid)

6. State Children’s Health Insurance Program (SCHIP)

7. Supplemental Security Income (SSI)

The big ones are OASI (Old Age and Survivors Insurance), SSI (Supplemental Security Income), Medicare, and Medicaid. Two of the programs have trust funds – OASI and Disability Insurance. They are sometimes considered to be one program but there are two trust funds for the purposes of providing accounting and holding accumulated assets. They are managed by the Department of the Treasury. The benefits paid from the OASI are dispersed to retired workers and their families. Disabled workers are paid by the DI trust fund.

So…I hear you asking, Lee, what do you mean “managed” by the Department of the Treasury? I’m glad you asked.

Federal law states the trust funds must be managed on a daily basis. As part of that, required managed securities, only available to the trust funds, were developed. The Treasury calls them “Special Issues”. This means those securities, unlike in the past, are not available to the general public.

When you as a citizen buys public market securities, you have to let those securities mature or you have to lose a buck or two to get the money from them. Treasury securities are different because at any one time they can be cashed and basically are like holding cash.

At the end of each month the Treasury brain trusts get together and through some cryptic calculations, undecipherable by the public, decide what the interest rate for the securities will be for the next month. In 2009 the monthly rate of interest ran about three percent and the overall yearly rate for all investments was nearly five percent, so they are making some money for us.

One of the biggest questions about this money made, according to the SSA, is, are the funds borrowed by our government and used elsewhere (as securities) worthless IOU’s. This seems to me to be a great question and the SSA seems to have a vague answer. The money gets spent by the government for various government type things, so the money is gone. It would appear old Uncle Sam will be unable to make good on the forced handshake with the American public. Here’s the vagaries the SSA gives us:

“Because the government spends this borrowed cash, some people see the current increase in the trust fund assets as an accumulation of securities that the government will be unable to make good on in the future. Without legislation to restore long-range solvency of the trust funds, redemption of long-term securities prior to maturity would be necessary.”

“Far from being “worthless IOUs,” the investments held by the trust funds are backed by the full faith and credit of the U. S. Government. The government has always repaid Social Security, with interest. The special-issue securities are, therefore, just as safe as U.S. Savings Bonds or other financial instruments of the Federal government.”

“Many options are being considered to restore long-range trust fund solvency. These options are being considered now, over 25 years in advance of the year the funds are likely to be exhausted. It is thus likely that legislation will be enacted to restore long-term solvency, making it unlikely that the trust funds’ securities will need to be redeemed on a large scale prior to maturity.”

With such a wonderful nod from the government, I know I feel better now (he says facetiously). We are in trillions of dollars of debt, but, oh yeah, those securities are in great shape. Should we get our bankruptcy papers together now, Uncle Sam?

In 1982, for those who may not remember, the OASI was almost depleted. Congress leapt to the rescue by “enacting temporary emergency legislation that permitted borrowing from other federal trust funds and then later enacted legislation to strengthen OASI Trust Fund financing.” The up side of that is the loan was paid back within four years with interest. Do I really have to go into the down side, especially taking into consideration the present economy?

I have to say it just doesn’t make me feel comfortable. It’s just a case of borrowing from Peter to pay Paul. I’m just glad Peter was a forgiving man. Maybe the seniors involved in this situation may be just as forgiving but I don’t think so. The hierarchy of needs just flashed through my head.

On top of the obvious, the 2037 date of non-sustainability came from the SSA itself, not just outside sources, but all in all, it’s just not looking good. They all cite the same things we’ve all heard. There apparently are a lot of pre – old people like myself waiting for that wonderful day we’re calling retirement, but it kinda looks like we shouldn’t be counting the social security chickens yet. With that, and the new life expectancy of 83 years, retirement may be more work that my writing career, which, by the way is not as easy as you would think.

The SSA calls social security an entitlement program, meaning you are “entitled”, or rather that you are allowed to participate in the program. I don’t remember being given that choice, but that is the case. Conversely, since it is an “entitlement” program, congress, in its infinite wisdom, can change the rules for your entitlement at will. In other words, if the program does become insolvent, they can pare down the people allowed to collect. You may or may not get social security no matter how long you have paid into the system. That’s just the way it is.

I don’t see them paring down their retirement funds, however.

One of those changes they are talking about is privatization. The pro side of that proposal is that it would allow people to control their own social security destiny. This would mean you could, very theoretically, provide for higher returns. A few bad decisions might, however, mean you could lose it all. Don’t you just love the stock market?

Social Security has earned about two percent over the years where private stock accounts have averaged about eight percent, so there is an advantage to the private accounts. It would require a certain discipline for private citizens to make money and the risk is greater, presumably. If the system goes in the drain as many believe, however, the risk might be just the opposite, and social security is a game of monetary spin the bottle.

Social Security would stay in place for those that want it, but the removal of funds to private accounts would lower the benefits for those using the SSA program, many say. That makes sense since there’s less money going in, there would be less money available to go out. There’s several schools of thought about that, but at first blush, that’s my take. Maybe it should be an all or nothing situation.

To do the privatization there would be a catch up period as well. Suddenly all the people wanting to privatize would be moving their money over, taking income from the SSA. Meanwhile, back at the check writing ranch at the Treasury, business would be normal, and they’d be writing checks to the existing entitled. Those against privatization say that lapse of income could cost between $1 to $2 trillion.

You may not know this, but ol’ Lee here is not a big fan of our government. Well mainly I don’t like politicians. Privatization advocates love the idea of removing the largest bureaucracy in the world. I have to admit that does sound appealing. It is still the greatest country in the world, don’t get me wrong, but like any big government there are built in problems. We all know about those. This problem with the SSA is a real and fearful problem. I want to know I am going to have some money to retire on, and would like to know also the money I have spent putting into the system will be returned when I need it most in the fall of my life.

Well, speaking of bureaucracy, Wall Street has its downside like everything else. They would be making their money too. There would be economy timing issues and everyone having to learn a new system. In some ways the SSA is a simpler system for the average non – investor. Teaching them would take some time and not everyone would make great choices in spite of classes, etc.

One thing to note. This isn’t a condemnation or an approval for either side. It’s just stating fact. Most proponents of privatization are Republicans, and vice versa. When you look at the platform for privatization and the basic platform for the Republicans, that makes sense, as does governmental control to the Democrats.

I’d like to think my future retirement years would be financially not a worry, and it’s as simple as having paid into a system that will pay me back because I paid into it all my working life. I’m not really thinking privatization is a great idea right now, but I have to say, I am definitely worried about the state of social security. At least I can write as long as I can think. Some people don’t have that option.