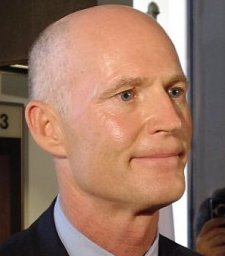

Gov. Rick Scott’s budget office will make a comprehensive review of special taxing districts and make recommendations for cutting costs and “introducing accountability.”

Scott issued an executive order Thursday ordering the review – similar to a months-long review undertaken by a special commission looking at public hospitals and another looking at water management districts. Those special taxing districts won’t be included.

“A major factor in our goal of lowering the cost of living for Floridians are the roughly 1,600 special districts in Florida which bring in more than $15 billion in taxpayer-funded revenues each year,” Scott said in a statement accompanying the executive order. “Floridians have a right to know what they’re being taxed for and how that money is spent. This review will bring to light these questions and allow us to identify ways to save taxpayers money and increase accountability.”

Scott’s office said the districts would be reviewed to see whether they serve the purpose for which they were created, whether they’re being efficiently governed, are accountable to taxpayers, are operating transparently and prudently spending tax money, among other issues.

“With such a significant impact on the lives of every Floridian and our economy, it is critical that we get a firm grasp on how these special districts are operating and hold them accountable,” Scott said.’

The state Department of Economic Opportunity says there are 1,634 special districts, though 16 are inactive. Their functions range from running airports and financing affordable housing to the management of utilities and wastewater systems. Soil and water conservation districts, for example, of which there are 63 in the state, are types of special taxing districts.

The governor ordered his Office of Policy and Budget to report back to him on what it finds, though he didn’t set out a deadline for the report.