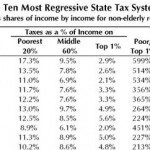

Poor Floridians pay almost six times as much of their earnings in taxes as do the wealthy, while middle-income families pay up to three-and-half times as high a share as rich families, a recent study has revealed.

The Study entitled, “Who Pays? A Distributional Analysis of the Tax System in All 50 States“, found that Florida’s tax system is the second-worst (regressive) in the U.S., with Washington being the worst.

The Study entitled, “Who Pays? A Distributional Analysis of the Tax System in All 50 States“, found that Florida’s tax system is the second-worst (regressive) in the U.S., with Washington being the worst.

Prepared by the Washington-based Institute on Taxation & Economic Policy, the study revealed that apart from Florida and Washington, eight other states comprise the “Terrible Ten” and these are: Tennessee, South Dakota, Texas, Illinois, Michigan, Pennsylvania, Nevada, and Alabama. According to the study, “these ten states stand out for the extraordinary degree to which they have shifted the cost of funding public investments to their very poorest residents.”

The report identifies several factors that make these states more regressive than others:

# The most regressive states generally either do not levy an income tax, or levy the tax at a flat rate;

# These states typically have an especially high reliance on regressive sales and excise taxes;

# These states usually do not allow targeted low-income tax credits such as the Earned Income Tax

Credit; these tax credits are especially effective in reducing state tax unfairness.

The main finding is that all 50 states’ tax system is fundamentally unfair and with an increasing awareness of the problem many are considering progressive tax reforms, including low-income tax credits and high-end income tax increases.

Despite this however, the study notes that the same lawmakers have continued to use regressive sales and excise tax hikes to fund essential services, thus thwarting progressive impact of such low-income tax credits.

The study concludes by observing that the current economic slowdown will likely force many states to undertake the very unpopular debate on revenue-raising tax reforms.

“The results of this study should provide an important blueprint for lawmakers seeking to understand the inequitable tax structures enacted by their predecessors. States may ignore these lessons and continue to balance state budgets on the backs of their poorest citizens. Or they may decide instead to ask wealthier families to pay tax rates more commensurate with their incomes. In either case, the path that states choose in the near future will have a major impact on the well-being of their citizens — and on the fairness of state and local taxes,” conclude the authors.

Source: ctj.org