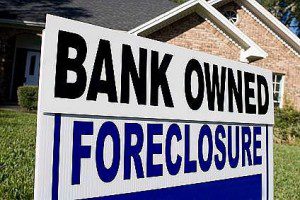

The government’s largest effort to compensate victims of the banks’ foreclosure practices is finally sputtering to an end. But for most of those eligible – nearly three million borrowers – it won’t be much of an ending: they’ll be receiving a check for $300 to $500.

For many borrowers, it’s likely an unsatisfying end to a process defined by years of frustration. If you were a homeowner in danger of losing your home at the height of the foreclosure crisis, chances are you soon discovered that your bank’s mortgage servicing division was a mess. They were hard to reach, gave you misinformation, lost your documents, and generally screwed things up. In some cases, homeowners were even foreclosed on by mistake.

In 2011, federal bank regulators announced a process to right these wrongs. The Independent Foreclosure Review had a simple aim. If a borrower had suffered “financial injury” (the emotional toll would not be considered), then the review would make it right. Compensation payments would range as high as $125,000.

But for borrowers, it was yet another descent into confusion. Just as so many had waited months and often years for an answer from their servicer, homeowners sent in a pile of documents and watched and waited as 2011 turned into 2012 and then 2013.

The review process ended with a whimper early this year. The process was such a mess, regulators announced, that they’d decided it was better to call it quits. No more trying to determine each borrower’s “financial injury.” The banks would just cut a check for millions of homeowners who had been in foreclosure, regardless of whether they were wronged.

But even this solution had its complications. Not all borrowers would get the same amount. Instead, regulators said they would break the four million borrowers into various categories. But regulators didn’t announce what the different categories would be or how much borrowers might be receiving. Borrowers would just have to wait a little bit longer.

Read More Here.