This article was published by americanprogress.org.

Today’s jobs data from the Bureau of Labor Statistics combined with other economic indicators—including the relative slow growth in gross domestic product in the first quarter and the slowdown in manufacturing activity—should make it clear to policymakers that there is much work ahead to address a troubled labor market. They should focus first and foremost on doing no harm and acting to sustain, not derail, the economic recovery.

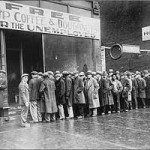

The job market has weakened considerably as employers added a total of only 54,000 jobs in May. The unemployment rate was unchanged at 9.1 percent. May is the 23rd month of unemployment at or above 9 percent since the Great Recession began, more months of such high unemployment than any other recession going back to the Great Depression. And the Bureau of Labor Statistics reports that there is no evidence that May’s poor job data is due to weather-related shocks.

The job market has weakened considerably as employers added a total of only 54,000 jobs in May. The unemployment rate was unchanged at 9.1 percent. May is the 23rd month of unemployment at or above 9 percent since the Great Recession began, more months of such high unemployment than any other recession going back to the Great Depression. And the Bureau of Labor Statistics reports that there is no evidence that May’s poor job data is due to weather-related shocks.

Making matters worse, Congress is dithering on increasing the debt ceiling. Failing to do so will lead to a sharp and immediate drop in economic output due to reductions in government spending and investment and their effects on the private sector. Clearly, today’s data show that the labor market would be unable to handle such a large shock, and employers’ confidence in the ability of Congress to act may be already shaken.

There is little to boost confidence that the labor market is on the right track in today’s report. Private-sector employers added 83,000 jobs in May after adding an average of 244,000 per month over the prior three months. Government continued to shed workers, with local governments laying off 28,000 employees. The continued cutbacks in government spending at the state and local levels are dragging down the jobs recovery. And manufacturing shed 5,000 workers in May after strong gains in recent months when it added an average of 27,000 jobs each month from February through April.

Employers would likely be ramping up hours of current employees or taking on temporary workers if they were looking to add jobs in the months to come. But neither indicator shows signs of optimism this month. The temporary-help sector shed 1,200 jobs in May, for a total of 2,800 jobs shed since March. Average weekly hours for all employees were flat at 34.4 hours per week in May, and manufacturing overtime hours were flat at 3.2 hours per week.

The Republicans and Democrats came together in December to enact a compromise that would extend tax cuts and unemployment benefits, understanding that this would lead to deficit spending. Given today’s data, immediate cuts in spending and investment would be the wrong policy to help maintain a recovery in the labor market.

At the same time, states are moving forward on policies that will reduce the availability of unemployment benefits even as today’s data show that the U.S. economy continues to have a historically high level of unemployment and specifically long-term unemployment. The share of workers who are long-term unemployed—that is, out of work and searching for a job for at least six months—ticked back above 45 percent in May. This share has hovered above 40 percent for 18 months. Those are highs not seen since the Bureau of Labor Statistics began tracking these data in 1948.

Workers across the spectrum continue to see long-term unemployment. Among management professionals, 47 percent were long-term unemployed in May, while among those employed in the durable goods manufacturing industry, 55 percent were long-term unemployed.

Even so, 17 states have either limited the availability of unemployment benefits or reduced the benefit level, and Republicans have put forth a proposal that would further encourage benefit reductions. Rather than cutting benefits for those who are out of work due to no fault of their own, Congress should enact comprehensive unemployment insurance reform that will ensure workers—and the economy—get the help they need when the unemployment rate is high.

High unemployment is only the tip of the iceberg, though. Workers who have a job are experiencing downward pressure on wages due to the lack of employment options. Over the past year, wages grew by a quarterly annual rate of 1.6 percent, while the rate of inflation, as measured by the consumer price index for all urban consumers, rose by 3.1 percent. With wages failing to keep up with inflation, even families still fully employed will not be able to increase their consumption or quickly pay off debts, which means we cannot look to consumers to be a strong driver of growth in the months to come.

We don’t want to make too many inferences from one month of bad data. But the combination of today’s report and other economic indicators should be a sobering wake-up call to policymakers that they are not done addressing the jobs crisis.