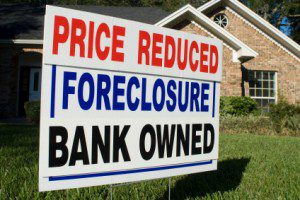

With Florida atop or near atop the list of foreclosure-ridden states, lawmakers on Thursday began looking again at ways to speed up the handling of foreclosure cases that now can take two years or more to wind their way through the courts.

Florida’s requirement that foreclosure cases go before a judge continues to slow the process, according to a senate interim report and statistics compiled by the Mortgage Bankers Association, which on Thursday released its latest findings on foreclosures and delinquent loans.

Florida’s requirement that foreclosure cases go before a judge continues to slow the process, according to a senate interim report and statistics compiled by the Mortgage Bankers Association, which on Thursday released its latest findings on foreclosures and delinquent loans.

Florida is among the roughly half of U.S. states that requires foreclosure proceedings to be handled in the courts, a requirement that has led to a backlog of cases that critics say is slowing Florida’s economic recovery.

“The foreclosure inventory rate remains quite elevated, but is at the lowest point since last year,” said Michael Fratantoni, MBA’s Vice President of Research and Economics, in a statement. “The disparity in loans in foreclosure between the judicial and non-judicial states continues to widen as backlogs continue with more new foreclosures entering the pipeline.”

Based on the percentage of loans that are in the foreclosure process, Florida had the highest rate at 14.5 percent for the quarter ending Sept. 30. Florida was followed by New Jersey (8.08 percent) and Nevada (7.89 percent), according to MBA figures released Thursday. Nationally, about 4.4 percent of loans were somewhere in the foreclosure process at the end of the third quarter.

In the new foreclosure category, Florida ranked second behind Nevada in the number of proceedings initiated during the quarter, the trade group reported.

“This is one of the real drivers of the problems we are having with our economy right now,” said Sen. John Thrasher, R-St. Augustine. “(We need to do) whatever we can do within reason and in fairness to everybody, to expedite some of these proceedings.”

The issue has pitted business groups and bankers and homeowner attorneys and legal aid groups, who say the slower pace gives financially strapped homeowners the benefit of having judges presiding over their cases.

On Thursday, the Senate Judiciary Committee was briefed on Florida’s foreclosure system. Some lawmakers are looking at ways to set up a non-judicial procedure in which the lender does not have to secure a court order to foreclose.

Last year, lawmakers enacted a measure allowing such procedures on timeshare properties. Foreclosure of other commercial and residential properties, however, must still be settled in court.

During fiscal year 2009-2010, lawmakers earmarked one-time funds to help reduce a backlog of cases that had piled up following the housing crash that began in 2007. The backlog of mortgage foreclosure cases has fallen since then from 462,000 cases to fewer than 261,000, according to senate staff.

Lawmakers are expected to again explore the possibility of expanding the use of non-judicial review. That, coupled with another infusion of funding, could put the state over the hump.

“We would be able to clean out the foreclosure backlog here in the state of Florida without any significant difficulty,” said Sen. David Simmons, R-Maitland.

By Michael Peltier